Tax brackets 2022 calculator

Calculate the tax savings. Updated for 2022 tax year.

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Federal California taxes FICA and state payroll tax.

. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters. Your bracket depends on your taxable income and filing status.

The Canada Annual Tax Calculator is updated for the 202223 tax year. Updated for 2022 tax year on Aug 31 2022. The Tax Caculator Philipines 2022 is.

Total Expected Gross Income. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

The calculator reflects known rates as of June 1 2022. The next six levels are. This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in.

In the section we publish all 2022 tax rates and thresholds used within the 2022 Malaysia Salary Calculator. The income tax brackets for 2022 are. As of 2016 there are a total of seven tax brackets.

See where that hard-earned money goes - with Federal Income Tax Social Security and other. And is based on the tax brackets of 2021 and. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10.

Under 65 Between 65 and 75 Over 75. Use the 540 2EZ Tax Tables on the Tax. Up to 10 cash back TaxActs free tax bracket calculator is an easy way to estimate your federal income tax bracket and total tax.

Personal tax calculator. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Income falling within a specific bracket is taxed at the rate for that bracket.

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. The income tax slab and rates for FY 2021-22 is important as it is needed to.

Calculate your combined federal and provincial tax bill in each province and territory. Calculate your total income taxes. The lowest tax bracket or the lowest income level is 0 to 9950.

There are seven federal income tax rates in 2022. Daily Weekly Monthly Yearly. Still this time we will calculate the tax due instead of calculating the percentage through the following.

10 12 22 24 32 35 and 37. The new 2018 tax brackets are. It is mainly intended for residents of the US.

There are seven federal tax brackets for the 2021 tax year. Here is the latest income tax slabs and income tax rates for FY 2021-22 and FY 2022-23. This calculator does not figure tax for Form 540 2EZ.

The table below shows the tax brackets for the federal income tax and it reflects the rates for the. Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. How to calculate income tax for citizens.

The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Excel Formula Income Tax Bracket Calculation Exceljet

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Income Tax Brackets Income Tax Return

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Ready For Tax Season Federal Income Tax Guide For 2018 Financeideas Familyfinance Tax Guide Federal Income Tax Income Tax

How To Calculate Federal Income Tax

Casio Sl797tvblack Tax Calculator In 2022 Calculator Casio Tax

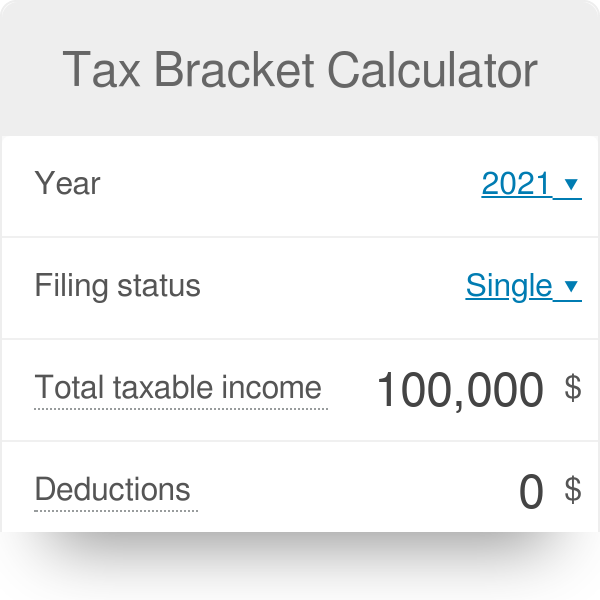

Tax Bracket Calculator

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Monroe Ultimatexb 12 Digit Ikt Desk Print Calculator Black Walmart Com In 2022 Calculators Prints Colorful Prints

Tax Calculator Estimate Your Income Tax For 2022 Free

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

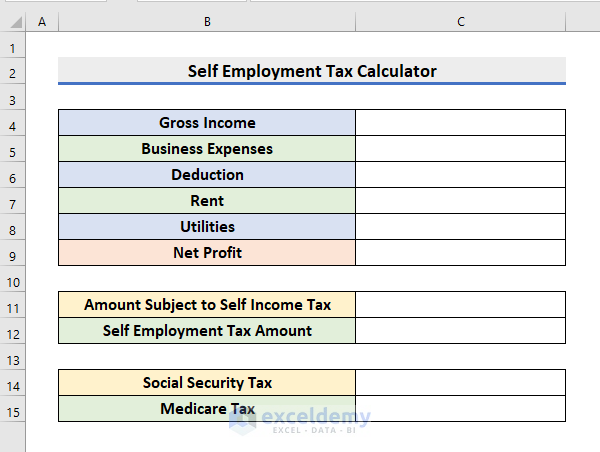

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Sales Tax Calculator

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help